Mountain View, CA. In today’s dynamic financial landscape, navigating personal finances requires not only diligence but also a reliable ally. PocketGuard emerges as that ally, offering a comprehensive suite of tools designed to streamline financial management while prioritizing user privacy and security. Since its inception in 2015, PocketGuard has witnessed significant growth, assisting users in reaching substantial savings milestones, settling debts, and reducing bills. With the recent closure of Mint, an announcement by Intuit, PocketGuard stands poised as a superior alternative, offering enhanced functionality, data privacy, and a commitment to user-centricity.

Why Choose PocketGuard?

Intuit’s decision to shutter Mint underscores the shifting landscape of personal finance management. As Mint transitions from a finance-focused entity to an advertising-driven platform, users are left seeking alternatives that prioritize their financial well-being and privacy.

PocketGuard fills this void, offering a subscription-based model that aligns company interests with user interests.

Standout features

Debt Payoff Planner: PocketGuard offers a tailored approach to becoming debt-free. By analyzing your accounts, interest rates, and monthly payment amounts, PocketGuard crafts a personalized plan. This easy-to-understand plan provides clarity on when each debt will be paid off, empowering users to take control of their financial future.

Savings Goals: With PocketGuard, achieving your savings goals is within reach. Whether it’s an emergency fund, dream vacation, or a new car, PocketGuard allows you to set multiple savings goals effortlessly. Simply enter the target amount and date, and PocketGuard will calculate the required monthly contributions. Additionally, it adjusts your budget dynamically to ensure you stay on track towards achieving your goals.

Bill Negotiation: PocketGuard Plus members enjoy exclusive access to bill negotiation services. Real people are on hand to liaise with service providers on your behalf, negotiating lower rates on recurring bills such as cable, internet, insurance, and more. This feature not only saves you money but also alleviates the hassle of negotiating bills yourself.

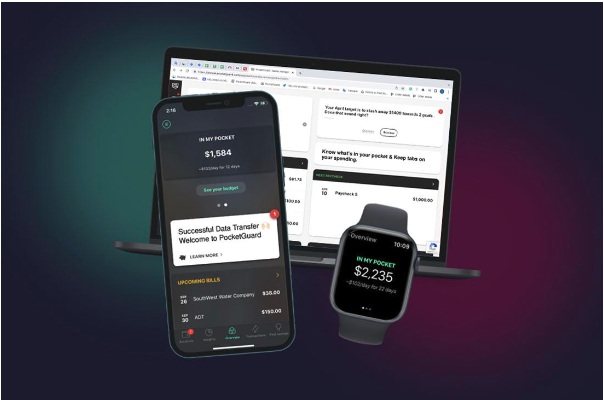

In My Pocket: The “In My Pocket” tool is a game-changer in financial management. By calculating your monthly surplus after accounting for bills and expenses, PocketGuard provides valuable insights into your available discretionary income. This feature empowers users to make informed decisions regarding their spending and saving habits, fostering financial stability and growth.

“Since our launch in 2015 we’ve achieved remarkable growth and impact. Over the past three years, PocketGuard has facilitated monumental savings milestones of $900 million, aided in settling debts exceeding $90 million, and effectively reduced bills by over $40 million.

The recent closure of Mint presented an opportunity for PocketGuard to showcase its agility and commitment to our users. In response to the needs of former Mint users, we swiftly introduced effortless data transfer solutions. This proactive approach has resulted in millions of users transitioning to PocketGuard, drawn by its familiar functionalities and promising future initiatives.

At PocketGuard, our dedication to empowering individuals to achieve financial success remains unwavering. We will continue to innovate and evolve, ensuring that our platform remains a trusted ally in the journey towards financial well-being.” – states Art Seredyuk, Co-founder at PocketGuard.

The PocketGuard Difference:

- Alignment of Interests: At PocketGuard, we recognize the importance of aligning company interests with user interests. Our subscription-based model ensures that users remain the primary beneficiaries of our platform, dictating its direction and evolution.

- Comprehensive Data Connectivity: PocketGuard integrates with multiple data aggregators to provide users with comprehensive coverage of financial institutions. This ensures fast access to accurate financial data, essential for effective budgeting and decision-making.

- Innovative Budgeting Features: Our unique “In My Pocket” calculation offers users a clear snapshot of their monthly financial performance, empowering them to make informed decisions and adjust their budgeting strategies accordingly.

- Advanced Debt Payoff Planning: PocketGuard offers personalized debt payoff plans tailored to individual financial situations. With features like the Avalanche and Snowball methods, users can prioritize debt repayment and track their progress towards financial freedom.

- Educational Resources: In addition to budgeting tools, PocketGuard provides users with a comprehensive personal finance management course. This resource equips users with the knowledge and skills to make sound financial decisions, fostering long-term financial literacy and empowerment.

- Responsive Customer Service: Our dedicated customer support team ensures that user queries and concerns are addressed promptly and effectively. With a commitment to excellence, we strive to enhance the overall user experience and provide unparalleled support.

Privacy and Security:

Privacy and security are paramount in the realm of personal finance management. PocketGuard prioritizes the protection of user data through robust security measures and proprietary fraud detection algorithms. By leveraging advanced encryption protocols and multi-factor authentication, PocketGuard safeguards user information from unauthorized access and exploitation.

In conclusion, PocketGuard stands as a testament to innovation, reliability, and user-centricity in the realm of personal finance management. With a steadfast commitment to privacy, security, and user empowerment, PocketGuard remains the ultimate ally for individuals seeking to navigate their financial journey with confidence and peace of mind. Join the PocketGuard community today and embark on your journey towards financial freedom.

About PocketGuard: PocketGuard is a budget app designed to simplify personal finance management and empower users to take control of their capital, making informed decisions to achieve their monetary goals through real-time expense tracking, personalized insights, and customizable budgets.

Media Contact:

Ira Solhan

PocketGuard

Email: isolhan@pocketguard.com

Phone: +351910839859